Unified Business Intelligence for Regulatory Compliance and Risk Management

Cleardil simplifies KYB and KYC due diligence through real-time verification and ongoing monitoring. It's easier for organizations to verify business partners and establish secure business relationships for safe business transactions. Stay compliant across EU and UK regulations! We also help you mitigate risks related to financial crimes such as money laundering and terrorist financing, supporting organizations to mitigate risks through advanced due diligence.

Contact Us See Plans

Complete Regulatory Adherence

Ensure full compliance with FATF (Financial Action Task Force, the key international standard setter for KYB and KYC regulations, KYC regulations, and AML regulations), 6AMLD, GDPR, AMF, and FCA guidelines, covering every jurisdiction across the EU and UK.

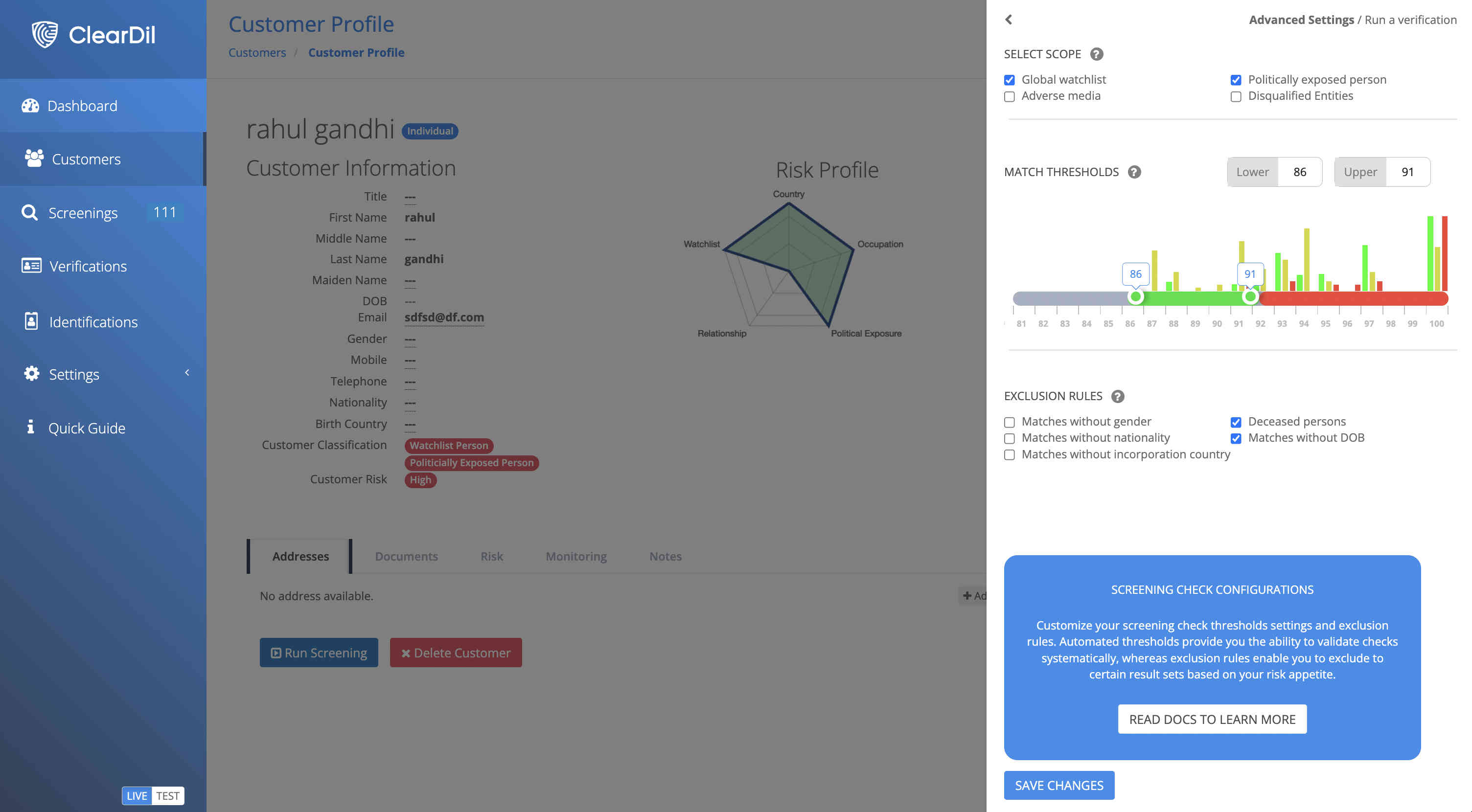

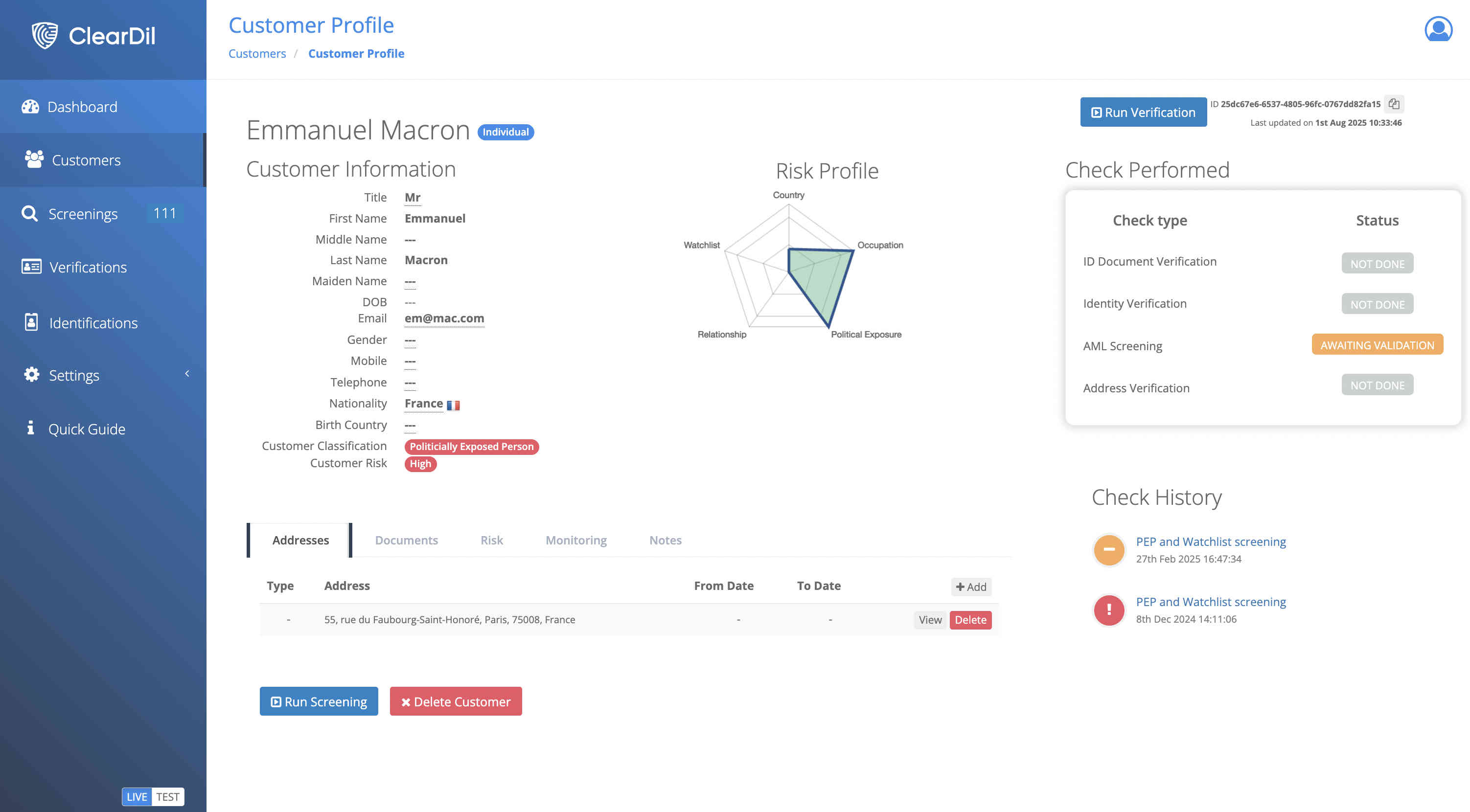

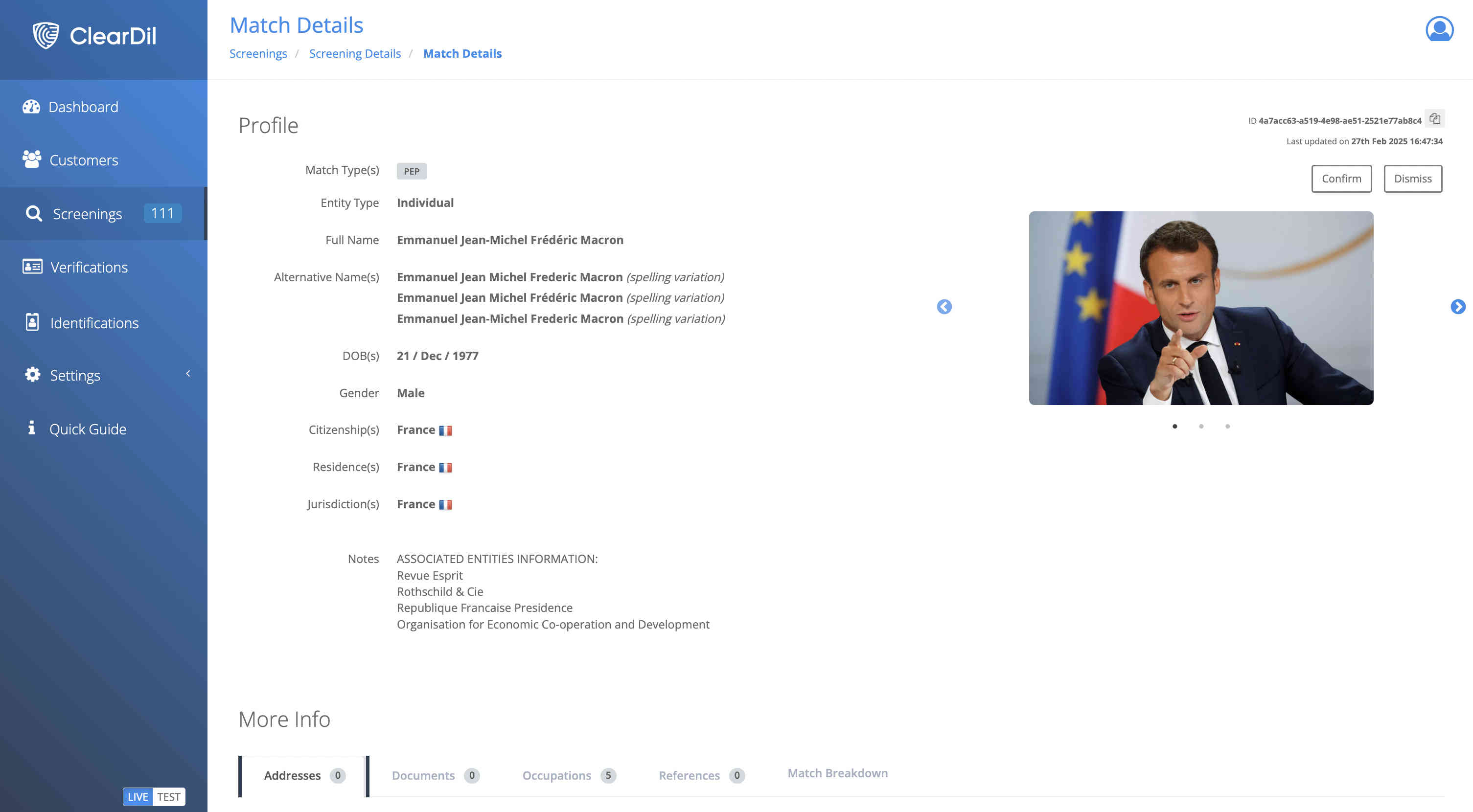

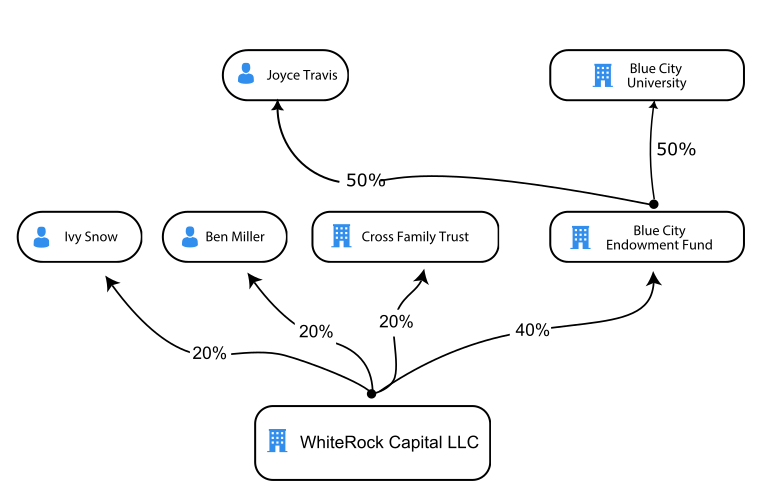

Real-Time Risk Assessment

Run automated screenings against PEP, sanctions lists, adverse media, and verify Ultimate Beneficial Owners (UBOs). You get 99.9% accuracy, while generating detailed customer risk profiles using advanced screening techniques.

Smart Operational Efficiency

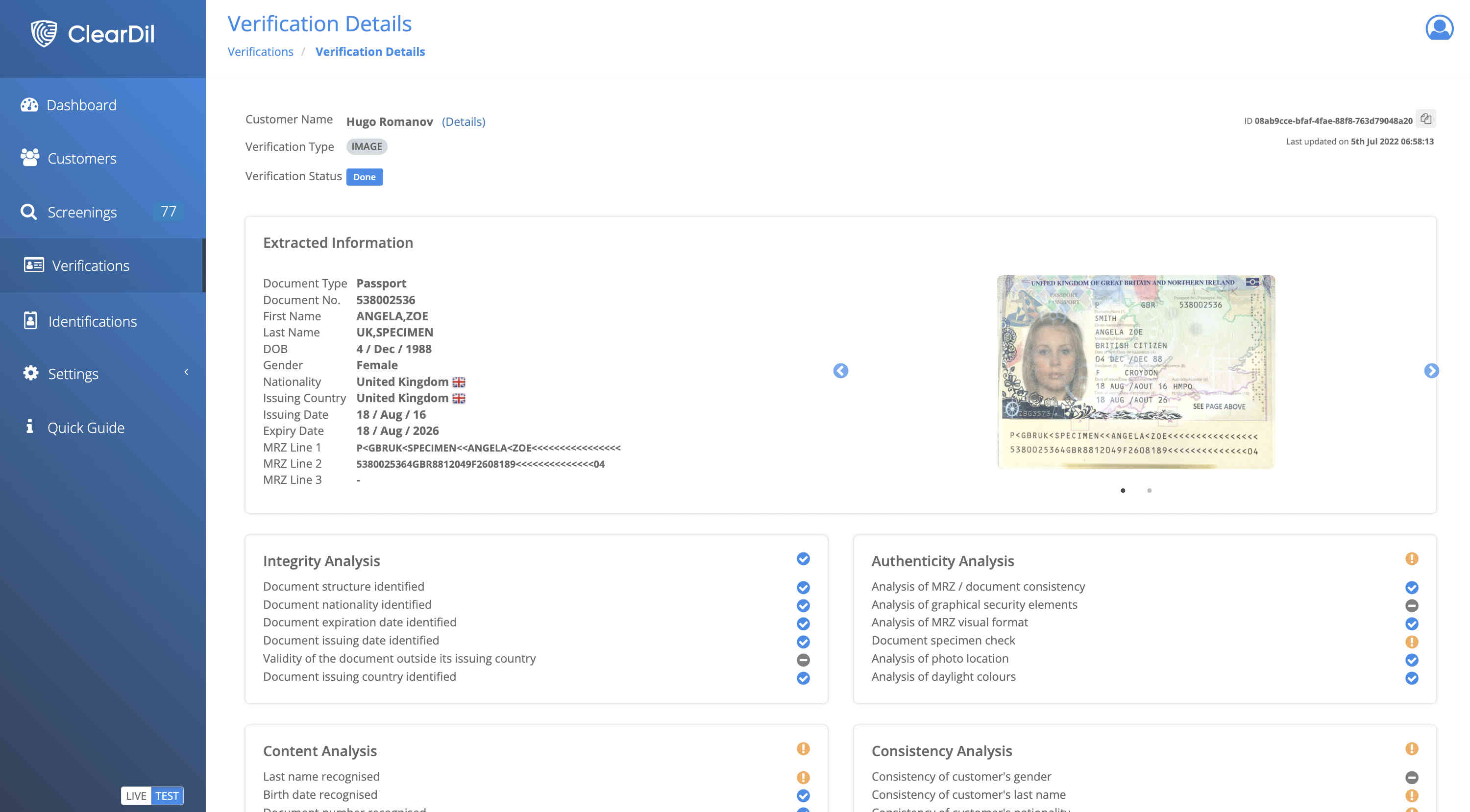

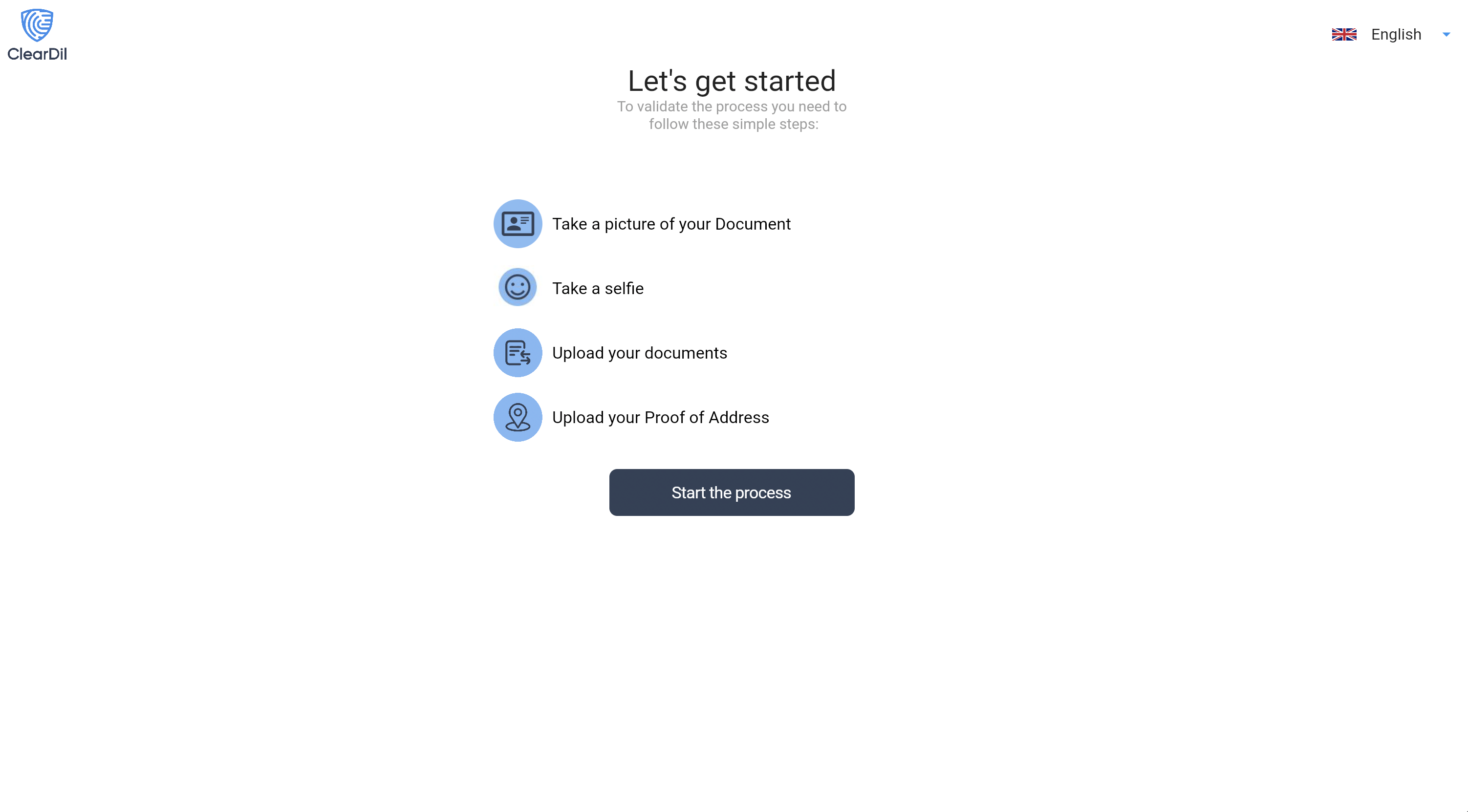

Reduce manual KYC/KYB effort by 80% through API-integrated workflows and AI-powered entity resolution for faster onboarding. You can now streamline the onboarding process by automating information collection, verification, and compliance checks.

Dynamic Financial Crime Detection

Enable continuous monitoring with real-time alerts for risk changes, including ongoing transaction monitoring to detect financial crimes. No need to worry anymore for money laundering, terrorist financing, and other financial crimes. We help you prevent fraud and shell company abuse.

Growth-Ready Compliance Infrastructure

Scale into new European markets with pre-integrated access to local registries (e.g., Companies House, Infogreffe) and ready-made onboarding flows. Stay within European Union regulatory frameworks.

360° Business Entity Profiles

Build detailed profiles with verified data: legal entity verification, ownership structure, legal status, business activities, industry classification, business registration details, filings, and beneficial ownership linkages.